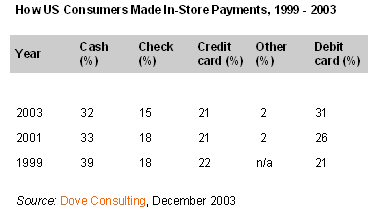

"...[T]he 'Check Clearing for the 21st Century Act,' or 'Check 21,' was passed, and will go into effect on October 28, 2004.With no float time left, one of the last major advantages of writing paper checks in the retail environment will be gone. Of course, this shift from paper checks to electronic transactions has been taking place for years --driven by convenience -- as this chart, showing in-store transactions in the U.S. illustrates (via ePayNews.com):

Although it was not the prime motivation for Check 21, it turns out that one of the by-products is the end of check float as we know it.

Practically speaking, when a customer presents a check for payment to a merchant with Check 21 capability, the amount tendered will be debited from the account at the point of sale, as with an electronic approval of a debit card. In fact, the merchant will likely just hand the check back to the customer after verification.

With Check 21, the days of shopping with checks first and making a deposit later are over.

So if a paper check is basically going to be treated as a debit card, it's easy to see how this icon of our consumer society will join 'float' in the history books. Indeed, one expert predicted that with Check 21, the current movement away from paper checks and toward electronic money, 'will shift into hyperspeed."'

Another goal of Check 21 is processing efficiency. Under the new law, banks won't be required to return cancelled checks. This will mean significant savings for banks, but if you rely on returned checks for record keeping you're going to need a new system."

UPDATE October 8: I cross-posted this article over at Blogcritics.org, and got some interesting comments. Join the conversation over there.

No comments:

Post a Comment