But just how bad off are small businesses today in the United States?

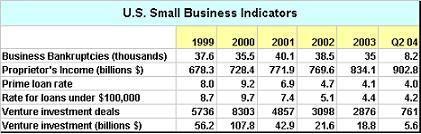

A recent report issued by the U.S. Small Business Administration gives a more optimistic perspective. The SBA's Quarterly Indicators tracks key economic statistics affecting small businesses. Those indicators tell the story of a very favorable economic climate for small business, as shown by this chart:

Business interest rates are at their lowest point in 5 years, making it attractive to borrow money for expansion. Proprietor's income is at its highest rate in 5 years, meaning more money for business owners. Business bankruptcies are trending lower, meaning more small businesses are making it.

The statistics also tell the story of resiliency in the aftermath of an artificial Internet bubble. Although venture capital deals have begun to trend back up in recent months, they are actually down from the heady heights of 1999 and 2000. However, in my view, that's a good thing not a bad thing. We all know that back then deals were getting funded that shouldn't have been. What we are seeing now is a leveling out toward historically sustainable levels.

(In the interests of size and readability I reformatted a portion of the report data into the above chart. You can view the original chart by downloading the entire Quarterly Indicators report here. The report has a lot of additional data and I recommend checking it out.)

I empathize with small business owners who may be having a rough time. I don't mean to minimize how unpleasant that may feel to anyone living through it. Just like many small business owners, I've had good times and not-so-good times alike. When I went through rough patches, I tended to view the world around me as not doing well either. But, always, it is the resiliency of entrepreneurs that enables us to bounce back.

The SBA report looks at objective factors. Looking at these factors, the current economy is a favorable environment for U.S. small businesses to start up, expand and invest in new equipment, services and other purchases.

No comments:

Post a Comment